1099 tax deductions list 2024 – For family coverage in 2024, the annual deductible is not less than $5,550, an increase of $200 from tax year 2023. The unpopular shared individual responsibility payment has been eliminated for . deductions and exemptions without an increase in real income. For tax year 2024 – for taxes payable in 2025 – the top tax rate remains 37% for individual single taxpayers with incomes or more .

1099 tax deductions list 2024

Source : www.facebook.com

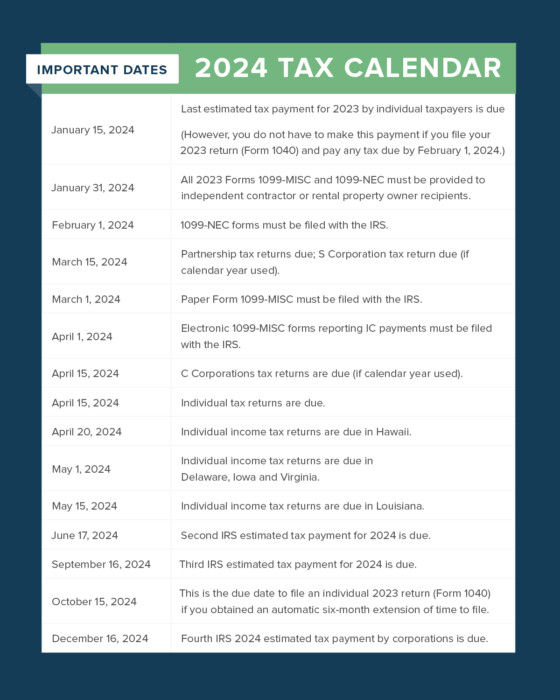

Business tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com

What Are Freelance Taxes? And How Do They Work? Ramsey

Source : www.ramseysolutions.com

Tax Firm Empire

Source : www.facebook.com

You may be able to deduct more from your income in 2024, IRS says

Source : news.yahoo.com

Moshe Klein & Associates, Ltd. | Chicago IL

Source : www.facebook.com

Free Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.com

Swalker Services LLC | Las Vegas NV

Source : www.facebook.com

Property Management Tax Reporting Made Easy | Buildium

Source : www.buildium.com

Found

Source : www.facebook.com

1099 tax deductions list 2024 QTax, LLC | Meredith NH: The inflation-adjusted elements will apply to the 2024 tax year, meaning returns filed in 2025. The standard deduction, which reduces the amount of income you must pay taxes on, is claimed by a ma . The same goes for some key aspects of federal income taxes, including the standard deduction and income brackets, which determine your tax rate. And 2024 will be no exception: Every standard .